What Most Get Wrong About Ecommerce Dynamic Pricing

Summarize with

Dynamic pricing isn’t just about raising or lowering prices—it’s about timing, data, and perception. Discover the hidden factors that separate winners from losers in ecommerce.

Even if you have the best product in the world, a poorly-planned pricing strategy can cause major problems for your company. Price it too high, and no one will be able to afford it; price it too low, and your profit margin goes “bye bye.”

The point is, your pricing strategy has a major impact on the success your eCommerce business experiences. Today, we’re going to talk about a specific pricing strategy used by many companies in eCommerce and other industries today: Dynamic Pricing.

Key takeaways

- Dynamic Pricing Explained: It involves adjusting product prices based on various factors like market conditions, industry standards, and consumer behavior to stay competitive.

- Benefits of Dynamic Pricing: It helps maximize profits by optimizing prices, ensuring competitiveness, and allowing granular control over product pricing.

- Pitfalls to Avoid: Key mistakes include neglecting regular adjustments, causing customer distrust through too frequent price changes, and engaging in a race to undercut competitors.

- Getting Started: Choose the right dynamic pricing software, gather relevant data, and ensure enough manpower to handle the complexity of the pricing strategy effectively.

On this page:

What is dynamic pricing?

Have you ever heard of competitor-based pricing?

How about market-based pricing?

Real-time pricing?

If you have, then you’re already at least somewhat familiar with dynamic pricing.

(Note: While often considered to be synonymous with “dynamic pricing,” these terms are actually types of dynamic pricing. We’ll come back to that a bit later.)

The simplest of definitions for dynamic pricing is as follows:

“Dynamic pricing is the process of setting and fluctuating your products’ prices over time based on a variety of factors, conditions, trends, and predictions.”

These factors include:

- Industry standards: Industry-wide average pricing; pricing ranges; most common prices amongst competitors

- Market conditions: Past, current, and future supply and demand; Consumer purchasing patterns/habits (both yours and your industry’s)

- Consumer expectations: How much your customers are happy to pay and how much they’re willing to pay; How much they expect to pay

Essentially, dynamic pricing is taking all three of the above-mentioned subsets and combining them into one full-blown strategy.

Now, this all sounds like a lot to keep track of (and there’s more, too!).

Don’t worry, though:

Implementing an effective dynamic pricing strategy isn’t meant to happen overnight. In fact, subtlety is key when introducing dynamic pricing into your strategic playbook.

(We’ll come back to this, as well.)

At any rate, this high-level overview should be enough to get you oriented on what dynamic pricing is all about. Now, the question is…

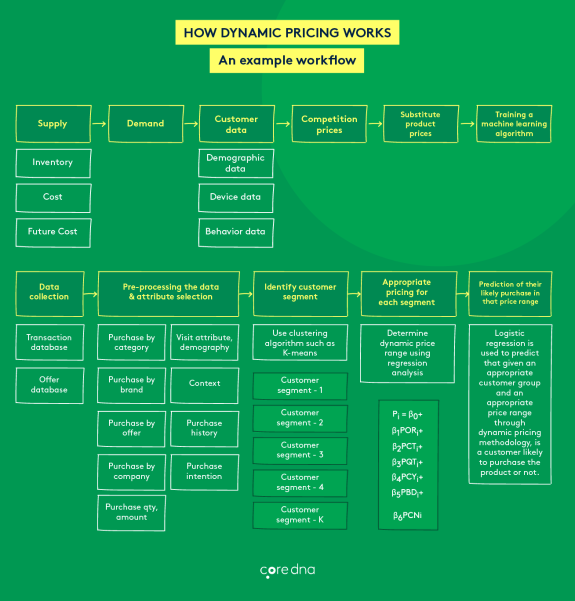

How does dynamic pricing work?

That’s a bit of a silly question, don’t you think?

After all, you already know how dynamic pricing works.

At least, you probably know the basics of it. I mean, you know that candy bars today cost more than they did when you were a kid; you accept that a hot dog at the ballpark costs $15; and you could swear gas was five cents cheaper when you drove by the convenience store just last night.

These rather common examples all show at least shades of dynamic pricing in some way or another:

- Inflation and all that comes with it have caused chocolate makers to increase their prices over the years

- Ballpark vendors control the supply of food and drinks while inside the stadium, so you basically have to pay their prices

- Gas prices often fluctuate daily because...well...you know what, does anyone really know?

All kidding aside, we’re talking about how dynamic pricing really works:

It all comes down to robust automation with a human touch at just the right moments.

Like we said earlier, dynamic pricing requires that you collect a lot of information about your industry, your competition, and your customers.

Collecting, organizing, and storing this data is a task better suited for a computer; however, it’s up to your team to define what data they’re looking for, which pieces of info are most important or valuable, and how each data point should impact your products’ pricing. Also, while dynamic pricing tools are made to suggest optimal prices for your products based on all of this data, such a vital moment again requires a hands-on approach from your team.

Let’s dig into the benefits of doing so in the first place.

The benefits of dynamic pricing

The main positive byproduct of using dynamic pricing is in the maximizing of both profit margin and sales throughout your company.

But there’s even more good news, here.

Adopting dynamic pricing as your go-to strategy essentially ensures you’ll always remain competitive in terms of price, regardless of what changes may occur. As you know, something is always in flux within every industry at any given time; by knowing and accepting this, you make it easier for your company to stay ahead of the curve.

“Adopting dynamic pricing as your go-to strategy ensures you’ll always remain competitive in terms of price, regardless of what changes may occur.”

Additionally, adopting dynamic pricing also enables you to be granular with your product data. In turn, it becomes easy to optimize your prices on a product-by-product basis.

Full-on dynamic pricing is thorough, in that any and all data that may influence the pricing of a given object is considered at all times, on an on-the-fly basis. As we mentioned earlier, this thoroughness is due in part to the use of software to automate data collection, and also in part to the people behind the “hands-on” moments that occur throughout the pricing process.

3 dynamic pricing pitfalls to avoid

Now, there are some potential traps to watch out for as you begin to implement dynamic pricing. While not a finite list, some of the most detrimental mistakes companies make when implementing dynamic pricing include:

1. Using a “Set it and forget it” attitude

Once again, believing your pricing software will take care of everything is a surefire path to disaster. Let the computer do the grunt work, but make sure you have hands-on-deck at all times.

2. Breeding indecision or distrust amongst customers

Fluctuating your prices too often can cause your customers to try to “wait you out” for a better price in the days to come. Or, worse yet, it may cause them to stop trusting your brand altogether.

3. Starting a race to the bottom

Simply undercutting your competition could cause them to do the same. In turn, the perceived value of your product will ultimately plummet.

We’ll get more into the main “dos” and “don’ts” of dynamic pricing in a moment.

For now, let’s talk about what you need before you get started.

Getting started with dynamic pricing: Everything you need to know

Alright, so the main components of dynamic pricing as we’ve discussed thus far are:

- Software

- Data

- Manpower

That’s it! That’s all you need to get started.

Okay, okay...let’s take a closer look at each.

1. Choose a dynamic pricing solution that fits your needs

Your pricing software of choice should be:

- Comprehensive

- Thorough

- Intelligent

That is, it should enable you to easily collect as much data as needed to strategically price a product; know how to translate these data points into meaningful and understandable information; and be able to use this information to make automated pricing predictions for now and in the future.

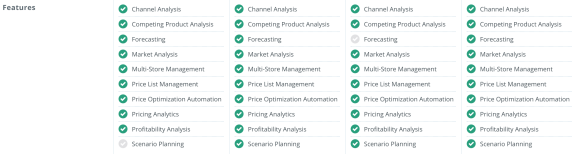

Specifically, you’ll want your pricing software of choice to offer the following features (as are included in the four highest-ranked pricing tools on Capterra

Your software of choice should also be easy to use, come with an offer of free service and support, and, of course, be offered at a price that fits your company’s budget.

2. Gather relevant data needed for dynamic pricing

We talked about this before, so let’s recap:

To effectively implement your dynamic pricing strategies, you need to work based off of data coming from a variety of sources.

In addition to everything we mentioned earlier (e.g., industry averages, consumer-related metrics, etc.), you also need to look inward, as well.

Get specific with your goals relating to profit margin, revenue, and company growth. Once you nail down these milestones, work out how you can use strategic pricing to help you reach them.

Simply put, without data to know where you’re going—and to know where you want to be—your dynamic pricing initiatives will have a tough time gaining traction.

3. Ensure you have the bandwidth to handle dynamic pricing

Despite the use of automation, adopting a dynamic approach to pricing will likely require even more manpower than you previously had dedicated to your pricing initiatives.

To reiterate, this human touch is needed for three main reasons:

- To define all which your automation software will do in terms of collecting and processing data

- To take this processed data, along with any automated predictions or suggestions, and make a real-world decision regarding pricing

- To ensure your automated software is fully-functional at all times, even when essentially on “cruise control”

While this extra use of human resources may be a bit of an investment for smaller companies, it will pay off in the long run when your use of dynamic pricing spurs your company to massive growth.

The dos and don’ts of dynamic pricing

As we’ve alluded to a few times throughout this article, your new dynamic approach to pricing can potentially lead your company to major success—but it can also be your downfall, as well.

Which side your company will fall to depends on how well you adhere to the following rules:

DO consider your industry’s and competition’s standards, but don’t follow them blindly

It may seem like simply setting your prices “somewhere” within the range of your industry’s standards is the safest course of action, but that’s definitely not the case.

Think about it:

You don’t know much, if anything, about your competitors’ internal metrics. You don’t know their cost of goods sold or their customer acquisition costs, and you certainly don’t know their overall business goals. It simply makes no sense for you to set your prices according to what everyone else in your industry is doing.

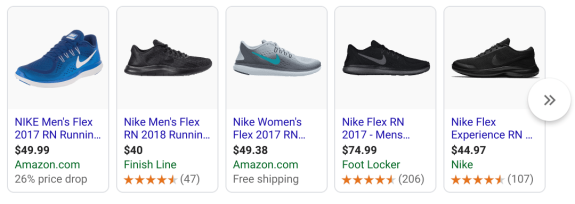

Take a look at the following screenshot:

Notice that first and the fourth products listed are the exact same sneaker. Now, notice that Amazon sells it for $49.99, while Foot Locker sells it for $74.99.

This tells me two things:

- Amazon can afford to sell the sneaker for less profit-per-sale

- Foot Locker makes enough profit-per-sale to offset the business it probably loses to Amazon (e.g., consumers looking for the lowest price)

You know what it doesn’t tell me?

If I’m really right about either of these things.

In order to really understand what the deal is with this pricing discrepancy (and how it should affect how my company prices that same product), I would need to do a bit more research.

Should you use these averages and ranges as a frame of reference? Of course; you probably will end up setting your prices somewhere within these ranges, after all. However, you want to get much more specific as to where this “somewhere” is by diving deeper into the many other factors in play.

DO be flexible, but don’t sacrifice your company’s goals

Obviously, the point of using dynamic pricing in the first place is to be flexible in your pricing based on the factors we’ve talked about in this article.

But “being flexible” is completely different from “bending over backward.”

Remember, your goal with dynamic pricing isn’t just to make sales; anyone can sell more by simply setting their prices at ground level. Your goal is to determine the exact price at which consumer purchasing friction is low, and profit margin is high.

That said, it can be easy to lose sight of your true goal, which in turn can cause you to make changes to your prices that don’t help your company all that much. Stay focused on your main goal, though, and your profit margin will skyrocket.

DO be opportunistic, but don’t take advantage

We all know that urgency- and scarcity-related tactics are pretty common in the world of eCommerce—and there’s nothing wrong with that.

There’s also nothing wrong with increasing your prices accordingly as demand begins to increase, either.

(After all, these are essentially the building blocks of a supply and demand economy, right?)

However, once again, there’s a difference between taking advantage of an opportunity, and taking advantage of the people behind this opportunity.

Say your eCommerce store sells sporting goods memorabilia, and you notice a former baseball player’s rookie card has increased in value over the last week; turns out, he was just inducted into the Hall of Fame. This awesome news for him is also great news for you: you’ll definitely be able to increase the price of anything with his name on it for the foreseeable future.

However, if it turns out the odd change in the card’s value was due to the man’s untimely passing, you have a decision to make. While it’s certainly not unheard of for those in such a position to ignore the human aspects of the circumstances and up the price anyway, those that do risk alienating their customers in a pretty irreparable manner.

To truly adopt a dynamic approach to pricing, you need to accept that you’ll never know enough to discover the indisputably “right” price of an item (and, even if you did, it would change pretty much immediately).

The ultimate goal as you implement dynamic pricing should be to continue learning as much as you can about your industry, your competitors, and your customers, and to stay focused on what all this information means for your products’ prices.

The ultimate guide to growing and scaling an ecommerce business